Prices for the most traded pre-owned AAA replica watches dropped sharply again in October, and are are now selling at levels not seen for a year or more.

Sites like Chrono24, Watchcharts and Subdial, which track prices of cheap UK fake watches on the secondary market, tend to over-state prices because dealers advertise products for higher prices than they are achieving in the current cooling market.

Even with this slightly rose-tinted view of the sector, there are now hot high quality Rolex replica watches like the steel on steel Daytona, that is cheaper to buy today than a year ago, despite a massive spike in the first quarter of this year.

Traders have been talking up the theory that pre-owned prices have found a floor since summer and now is a good time to buy, but the data suggest it is still a buyers’ market.

Chrono24 shows the price of an unworn, white-dialed Swiss made copy Rolex Daytona watches rising from $33,000 in October last year to $45,000 in April.

Today it is estimated to be worth $31,500, a third off its peak but still more than double its $14,550 price at an authorised dealer.

The most recent steel Daytona sold on Watchcollecting.com, a good place to check whether traders’ advertised prices are being inflated, went for £24,500 ($28,080 at today’s exchange rate).

The unworn 2021 best replica watches, sold on October 21, had a full set of box, papers and factory stickers.

Subdial.co estimates the same Daytona to be worth £24,384 after a 9.3% slump in the past 30 days.

Perfect fake watches, particularly from Rolex, whose prices rose fastest in the six months to the end of Q1 have subsequently fallen furthest.

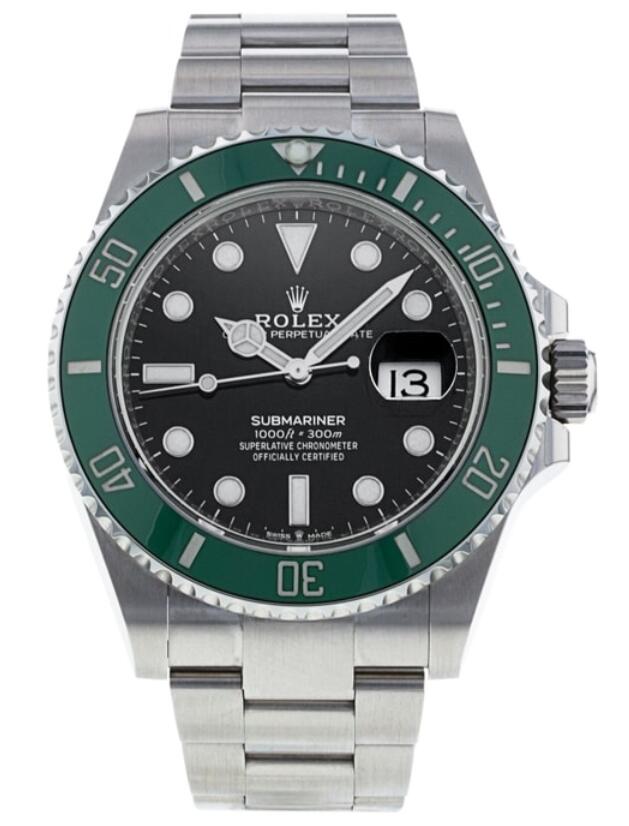

A Submariner with black dial and green bezel, known as the Kermit, saw its price rise from $18,365 in October last year to a peak of $25,519 in March of this year before losing almost all of that gain to trade today at $19,889, according to Chrono24.

Subdial has the price of the same watch at under $17,000. It retails for $10,100.

Rolex is not the only brand that is still cooling on the secondary market.

Luxury replica Patek Philippe’s near mythical Nautilus 5711 watches, which was discontinued last year, has seen its price drop by a third since peaking at around $220,000.

Today you can pick up an example for $157,000, according to Chrono24.

Also on the discontinued list, Audemars Piguet’s Royal Oak Jumbo super clone watches for sale, peaked at $155,000 and dealers will now accept $110,000.

A 2019 Jumbo sold on Watchcollecting.com in September for £66,250 ($76,000).